Current State of Discovery R&D | UnderReport kb

Current State of Discovery R&D

The Life Sciences Crisis Nobody Wants to Talk About

Introduction

Unfiltered Realities, Data-Driven Trends, and the Hard Truths Shaping Discovery-Stage R&D

Discovery-stage research in the life sciences – covering the early R&D pipeline from basic target discovery through preclinical proof-of-concept – is facing a challenging landscape in North America. This report provides an unfiltered analysis of the current state of discovery-stage therapeutic and diagnostic research across startups, large pharmaceutical companies, academic labs, and government institutes. We detail key trends, recent milestones, and objective (often underreported) realities defining this sector. The goal is a realistic, data-driven status update with no rose-colored optimism – just the facts and harsh truths shaping early-stage R&D.

Despite rapid scientific advances (e.g. genomics, AI, precision medicine), the ecosystem for early discovery is under strain. Funding for biotech startups has contracted sharply since its 2021 peak – nearly 50% of such companies could run out of money by end of 2025, leading to widespread budget cuts and project cancellations [1]. Large pharma companies, staring down major 2030 patent expirations on their cash cows (>$500B at risk industry-wide), are retrenching to “safe” projects and pipeline fill-ins via acquisitions [2]. They’ve focused on proven therapeutic areas (like obesity or well-known cancer targets) while more novel, high-risk programs are shelved [3]. Academic and nonprofit research institutes continue to generate novel ideas, but many fail to translate due to reproducibility issues and the notorious “valley of death” between lab discovery and clinical development. In fact, an estimated ~50% of preclinical findings cannot be replicated, wasting ~$25–28 billion of U.S. research spending each year [4]. Meanwhile, diagnostics R&D remains chronically underfunded, receiving only ~3% of total healthcare R&D investment since 2004 [5]. This severe imbalance slows innovation in disease detection and prevention and leaves many illnesses without early diagnostic tools.

In the sections that follow, we examine the financial and innovation landscape, dive into sector-specific trends (therapeutics vs. diagnostics), analyze how different classes of organizations are approaching discovery-stage research – and how that’s working out for each – and review the state of vendors, suppliers, and manufacturers that support the R&D ecosystem. Several tables and visual aids summarize key trends and realities. All information is drawn from recent industry analyses, surveys, and reports to ensure an up-to-date snapshot as of late 2025.

Biotech at Risk

Estimated proportion of biotech companies that could shut by end of 2025

Job Losses 2024

Biopharma jobs eliminated in 2024 amid funding cuts

Diagnostics Funding

Share of total healthcare investment going to diagnostics since 2004

Reproducibility Waste

Approx. annual US research spending wasted on irreproducible results

| Funding Crunch for Early R&D

Venture capital for biotech collapsed after 2021 , with early-stage investments down ~20% year-over-year in 2024. Many startups are in survival mode, and even big pharma is funneling resources into late-stage “sure bets” while trimming exploratory projects.

| Innovation vs. Reality

Despite hype around AI, genomics, and novel modalities, the harsh reality is that most early discoveries don’t pan out . Reproducibility issues plague ~50% of published findings, and promising lab results often stall before reaching patients due to technical or funding hurdles.

| Diagnostics Neglected

Diagnostics R&D lags far behind therapeutics. Only ~3% of healthcare R&D investment goes toward diagnostics tools, and 2023 saw a 37% plunge in diagnostics venture funding. Underinvestment here means slower progress in disease detection and prevention.

| Consolidation & Collaboration

A “survival of the fittest” dynamic is unfolding. Well-capitalized players are consolidating – exemplified by big acquisitions of smaller innovators – while weaker startups merge or fold. Industry-academia partnerships are more critical than ever to bridge gaps in expertise and resources.

Recent Timeline

Key Events (2020–2025)

To understand the current state, it’s helpful to review major events and trends over the past five years that have shaped the discovery-stage landscape:

-

2020: Pandemic Spurs Biotech Boom

COVID-19 drives unprecedented biotech funding. Investors pour money into vaccine and therapeutic research, pushing funding levels to historic highs. Breakthroughs like mRNA vaccine success validate rapid discovery-to-product pipelines.

-

Late 2021: Funding Peaks, Then Plummets

After a record early 2021, biotech capital markets collapse in H2 2021. By Q2 2022, funding has fallen back to 2019 levels . The abrupt downturn forces companies to prioritize critical programs (especially those nearing clinical milestones) and slash early discovery efforts.

-

2021: AI & Computational Advances

DeepMind’s AlphaFold AI releases predictions for virtually all known protein structures, heralding a new era for computational drug discovery (though questions remain on impact). In diagnostics, the FDA approves the first AI-assisted pathology tool (Paige Prostate) in 2021, showing AI’s potential in early detection.

-

2022: Regulatory Shifts Begin

The U.S. FDA Modernization Act 2.0 is signed, ending the mandate for animal testing for new drugs and allowing validated alternatives. This paves the way for organ-on-chip models and AI-driven tox studies – though these new methods will take time to prove and adopt.

-

2023: Focus on Late-Stage & “Safe” Bets

With funding scarce, biopharma companies double down on projects likely to yield near-term results. Many early R&D programs are put on hold. Investors favor areas like obesity and well-known cancer targets (PD-1, VEGF) – “sure things” in the current market – leaving riskier innovative targets orphaned.

-

2023: Consolidation Wave

The tough climate triggers mergers and acquisitions. Notably, Pfizer acquires Lucira Health(a small PCR diagnostics maker) out of bankruptcy for just $36M. Large life-science tool companies snap up niche innovators (e.g., Danaher buys Abcam for $5.7B; Thermo Fisher buys Olink for $3.1B). Reverse mergers become a lifeline for struggling diagnostics startups.

-

2024: Funding Drought Hits Home

The downstream effects become clear. In 2024 alone, >15,000 biotech jobs are lost and total sector funding falls ~10%. Early-stage venture deals drop sharply (e.g. tools/diagnostics VC financing down 37% vs. 2022). Nearly half of publicly traded small biotechs trade below cash value, unable to raise new funds – a purge of weaker players.

-

2025: Cautious Stabilization?

H1 2025 shows mixed signals. Global life-science VC funding ($18B) is still 16% below the prior year, and IPO activity remains at a trickle. Big Pharma’s patent cliff looms larger – over $500B in revenue at risk by 2030 – driving a $180B war chest for acquisitions. The question is whether enough new startups and research can survive today’s crunch to be tomorrow’s acquisition targets.

(The timeline above highlights the rollercoaster of the past five years – from boom to bust – and the major shifts affecting discovery-stage R&D.)

Funding & Investment Landscape

“High-Risk, High-Reward” Hits a Wall

In the early 2020s, North America’s life science sector experienced a funding whiplash. After the pandemic-induced surge of 2020–21, the capital flow to discovery-stage endeavors dramatically receded. This contraction has arguably been the single greatest factor shaping current R&D activities:

- · Venture Capital Retreat: Biotech investment plunged after mid-2021, creating a cash crunch especially for early discovery projects. By 2024, early-stage venture funding was ~20% lower than the year prior [1]. Many young biotechs that raised big rounds in 2020–21 found themselves unable to secure new capital, forcing drastic cuts. Nearly 50% of biotech companies are at risk of running out of cash by the end of 2025 according to an analysis by Ernst & Young [2]. This is a stark reality – a possible mass extinction event in the startup ecosystem, as some observers have put it. Companies that in 2021 might have raised a $50M Series B on promising preclinical data now struggle to get even a fraction of that, unless they’ve advanced to clinical trials or have star teams.

- · Flight to “Safe” Bets: In a risk-averse funding climate, investors (and pharma corporate venture arms) concentrate funds on programs with perceived lower risk and nearer-term payoffs. Therapeutic areas like metabolic disease (e.g. GLP-1 drugs for obesity) and well-validated oncology targets are receiving disproportionate attention, whereas novel, unproven mechanisms are largely shelved [3]. This “brutal selection” means only teams with stellar data or track records can raise substantial money [4]. Startups are increasingly built around whatever theme is in favor. For example, multiple new companies pivoted to obesity or AI-powered drug discovery in 2023 because that’s where investors sign checks – even if it’s a crowded space. Meanwhile, genuinely new approaches for diseases like Alzheimer’s or next-generation antibiotics languish for lack of willing backers.

- · Public Markets & IPO Drought: The window for biotech IPOs virtually shut after 2021’s frenzy. In 2022 and 2023, only a handful of biotech IPOs eked through, and those often at downscaled valuations. H1 2025 saw global biotech IPO proceeds down ~58% from the prior year [5]. With IPO exits off the table, venture investors became even more cautious (no quick public cash-out in sight). This led to a glut of “private-to-private” mergers and companies delaying expensive projects. For companies that did go public in 2020–21, many ended up trading far below their IPO price, hampering their ability to raise follow-on capital. The net effect: the traditional funding ladder (VC → IPO → follow-on raise) is broken for now, and young biotechs must either find alternative financing (partnerships, royalty deals, etc.) or drastically slow their R&D burn.

- · M&A as an Exit (and Lifeline): Conversely, pharmaceutical giants flush with cash are ramping up acquisitions to fill their pipelines. Facing a wave of patent expirations on blockbuster drugs, Big Pharma has earmarked roughly $180B for buying assets/companies by 2030 [6]. However, a real concern arises: if early-stage development is starved now, will there be enough viable startups to acquire later? [7] The current funding squeeze could ironically shrink the very innovation pool Big Pharma hopes to draw from. In 2023–2024, we saw an uptick in “fire-sale” acquisitions of distressed companies – for example, Pfizer’s bargain pick-up of Lucira Health (a diagnostics firm) for only $36M after it filed bankruptcy [8]. Such deals highlight how dire the situation became for some ventures. On the positive side, well-positioned biotechs with solid data have become prime targets (often at valuations much lower than a few years ago, making buyers happy). Pharma merger activity in 2025 started to rise, focusing on clinical-stage or emerging platform companies at reasonable prices rather than mega-mergers.

- · Spending Priorities Shift Inward: Within organizations, the funding crunch forced internal triage. Biotechs and pharma alike trimmed exploratory research and redirected resources to later-stage, “must-win” programs where return is more certain. A Bain analysis noted that companies “deprioritized expansive spend on discovery efforts” and even paused some preclinical projects to conserve cash for clinical trials [9]. In practice, this means pipeline breadth is sacrificed for depth: rather than advancing five early targets, a company might focus on one lead candidate and drop the rest. Budgets for platform development, novel target discovery, and other long-term bets were often first on the chopping block in 2022–2024. The result is an R&D portfolio that is narrower and more incremental. Even academic collaborations, traditionally a source of new ideas, saw reduced funding from industry partners during this period unless tied to clearly defined product outcomes.

The net effect is a far more constrained financial environment for discovery-stage R&D than existed in the late 2010s. The industry swung from exuberant capital availability to extreme selectivity in just a couple of years. For an R&D executive, the message is clear: early-stage innovation is happening under severe budget pressure, with many programs slowed or dead, and only the most compelling projects attracting support. “Nice-to-have” science projects are luxuries few can afford in 2025. This has significant downstream implications, explored further below in the therapeutics and diagnostics sections and in how organizations and suppliers are adapting.

Therapeutic Discovery

Trends and Harsh Realities

Discovery-stage therapeutic research (drug discovery for new medicines) has always been high-risk, expensive, and slow. In North America, thousands of programs in pharma companies, biotech startups, and academic drug discovery centers aim to find the next breakthrough therapy. But today’s harsh realities are reshaping how this work is done. Key trends and truths in therapeutic discovery include:

- 1. Pipeline Contraction & “Safe Bet” Science: With funding tight, there’s been a notable narrowing of research scope around “sure bets.” Companies are focusing on a smaller number of disease areas and targets that align with proven modalities. For instance, there is heavy activity in metabolic diseases like diabetes/obesity (spurred by the success of GLP-1 agonists) and continued investment in cancer immunotherapies. By contrast, “high-risk, high-reward” ideas – say a first-in-class drug for Alzheimer’s, or a new antibiotic mechanism – struggle to get traction. Big Pharma R&D groups have streamlined to fewer therapeutic areas, often those with clear commercial potential. Some areas of great medical need (e.g. novel antibiotics, certain neurodegenerative diseases) remain under-invested because the risk/return profile is hard to justify in today’s environment. This conservatism may ensure efficient use of R&D dollars in the short term but could mean fewer radical innovations long term. Insiders sometimes bleakly joke that portfolios are being pruned to what’s “safe to fail” – i.e. only projects that, even if they fail, won’t be criticized because they were the obvious ones to do.

- 2. Rise of AI and Computational Drug Discovery – With Caveats: Over the last few years, artificial intelligence has been touted as a game-changer for drug discovery. Indeed, AI and machine learning tools are now helping with tasks like hit identification, protein structure prediction (e.g. AlphaFold), and polypharmacology modeling. Notable milestone: DeepMind’s AlphaFold2 (2021) predicted structures for ~200 million proteins, many previously unmapped, raising hopes of exploiting new targets. Companies like Recursion and Insilico Medicine announced AI-designed molecules entering clinical trials. However, the reality is more tempered. A 2023 Nature report highlighted that while AlphaFold provides amazing structural data, it doesn’t automatically translate into viable drugs or lead compounds [1]. For example, Recursion’s much-publicized effort to predict billions of protein-ligand interactions using AlphaFold structures produced plenty of theoretical “hits,” but experts caution that without experimental validation those predictions mean little [2]. In practice, AI generates many hypotheses, but human chemists and biologists still must sort signal from noise. One underreported truth: AI has sped up parts of discovery (like virtual screening), but it has also created huge piles of false positives that teams must wade through [3]. Drug hunters now joke about drowning in AI-generated leads. The bottom line – AI is an exciting and useful tool (it can shave months off certain research steps and uncover non-intuitive ideas), but it hasn’t made drug discovery significantly cheaper or more successful overall yet. Lab work and empirical testing remain the rate-limiting steps, and many AI-proposed drug candidates falter once synthesized and tested in real cells or animals. The field is moving fast, so this might change, but as of 2025 the promised AI revolution in therapeutics is still in its early innings, with more hype than tangible ROI.

- 3. Advanced Therapeutic Modalities (New Science, New Challenges): The therapeutic toolbox has expanded beyond traditional small molecules and biologics into gene therapies, cell therapies, RNA therapeutics, protein degraders, etc. These modalities offer new ways to treat disease – potentially even cures – but each brings unique discovery-phase challenges. For example, cell therapies (like CAR-T) can be transformative for cancer, but discovering an effective cell product isn’t like screening a chemical – it involves engineering living cells and can take extreme iteration to get right. Similarly, gene editing therapies (e.g. CRISPR-based) require identifying the right genetic target and developing a safe delivery method to the correct cells – essentially two discovery problems in one. A harsh reality is that early programs in these cutting-edge modalities have had high failure rates and unforeseen setbacks. Many first-generation gene therapies ran into safety issues (immune reactions, off-target effects) that sent researchers back to the drawing board. mRNA therapies (beyond vaccines) face delivery and stability challenges that make discovery and optimization difficult. So while the science frontier is dazzling, the path to a product is often longer and costlier than optimists predicted. For instance, after the initial CRISPR therapy trials, researchers realized they needed entirely new discovery efforts for novel delivery vectors to target organs beyond the liver – an active area now, but one that will take time. The underreported point: each new modality comes with a steep learning curve. We’re essentially re-inventing the discovery process for each one (what works for small molecules doesn’t directly translate to discovering an effective siRNA, for example). This means timelines to first success in these modalities can be longer than anticipated, straining investors’ patience in the current climate.

- 4. Efficiency Pressures and Externalization: In response to cost pressures, organizations have looked to boost efficiency in discovery. One trend is heavy use of outsourcing – contract research organizations (CROs) are performing much of the routine discovery work (high-throughput screening, animal studies) that might have been in-house before. This variable-cost model lets companies scale down expenses quickly if needed (by cutting CRO projects) rather than maintain large fixed internal labs. Another efficiency push is automation and improved lab technologies – e.g., automated synthesis and testing platforms – to get more data per dollar spent. Big pharma has also become more inclined to let academia and biotechs “de-risk” early projects, then swoop in via partnerships or acquisitions once there’s proof-of-concept. Today well over half of new drug approvals originate from outside big pharma’s own labs (either discovered by biotechs or academic groups) – a testament to how pharma has externalized a chunk of discovery. While this can be efficient (pharma pays for winners, not all the attempts), it does rely on a vibrant biotech sector to produce those winners. With that sector under duress, pharma’s pipeline in, say, 2027–2030 could be in jeopardy. Another noteworthy shift: small biotechs themselves are merging or collaborating at early stages as a survival tactic. Rather than each burning limited cash on parallel discovery programs, two cash-strapped startups might merge to pool resources and focus on the most promising program from their combined portfolio [4]. While this can salvage value, it reduces diversity of approaches – effectively fewer independent shots on goal.

The table below summarizes key trends and gritty realities in therapeutic discovery as of 2025:

Table 1. Key Trends & Realities in Therapeutic Discovery R&D (North America, 2025)

| Trend/Reality | Current Status and Impact |

|---|---|

| VC Funding Whiplash Boom-to-bust in early-stage investment. | 2021: Record funding influx; pipelines expanded. 2022-2024: Severe decline – early-stage VC deals down ~20% YoY1. Many programs shelved; 50% of biotechs could run out of cash by 20251. This drought curtails exploration and increases reliance on later-stage projects. |

| Focus on “Safe” Targets Narrowing of research scope. | R&D resources gravitate to proven mechanisms (e.g. metabolic hormones, popular oncology targets). Investors favor “sure bets” like obesity and anti-PD1/VEGF therapies1. Reality: Novel target discovery for less common or high-risk diseases is left behind, potentially creating future innovation gaps. |

| AI & Big Data in Discovery Automation of idea generation. | AI-driven tools (e.g. generative chemistry, AlphaFold models) are widely adopted to propose drug leads. Reality Check: Flood of in-silico leads but low signal-to-noise – e.g., billions of predicted protein-ligand interactions lack experimental validation5. Human expertise and lab work remain the rate-limiting steps. |

| High Failure Rates Attrition remains brutal. | It still takes 5,000–10,000 compounds to find 1 viable drug candidate, and >90% of those entering clinical trials fail to reach approval (industry-wide truth). Reality: Massive sunk costs. One estimate suggests ~$50B/year of U.S. research spend is wasted on irreproducible or non-translatable results1, reflecting the inefficient churn in early discovery. |

| Modality Expansion Gene, cell therapies, etc. | New therapy types (gene editing, cell therapies, RNA drugs) open avenues to treat previously intractable conditions. Reality: Complexity and novelty mean higher risk – unanticipated toxicities, manufacturing woes, regulatory unknowns. Timelines for discovery and optimization are often longer than for traditional drugs, slowing their progress. |

| Big Pharma Pipeline Gaps Filling trough via deals. | Pharma devotes capital to acquire or license external candidates – preparing ~$180B for acquisitions by 20301 due to internal pipeline deficits. Reality: If shrinking early innovation isn’t reversed, pharma may face a dearth of quality targets to buy. The current strategy is sustainable only if the broader R&D ecosystem stays productive. |

Implications: Today’s therapeutic discovery teams must do more with less. They focus on projects with clear rationale and robust data, and often must prove a concept much earlier to attract funding for the next step. The old biotech model of “interesting science + big vision” securing large Series A rounds is largely gone; now investors want to see a tangible prototype or at least in vivo efficacy before committing. This “show me the data” ethos is tamping down speculative science. Internally, R&D leaders are pushing for faster kill/go decisions – the “fail fast” mantra – to conserve resources. If an experiment or candidate doesn’t show promise, it gets cut swiftly rather than linger in the pipeline. Efficiency is up, but this austerity can make researchers more risk-averse, avoiding unconventional ideas that might not have immediate payoff. For the future, the concern is that today’s conservatism sows the seeds of a lean innovation harvest later. Conversely, there’s an opportunity: those who do sustain bold discovery efforts now (whether through creative funding, partnerships, or government support) could end up with truly differentiated therapies when the cycle turns upward again. Balancing the R&D portfolio between incremental “safe” bets and a few transformative moonshots is more important than ever, albeit hard to do under financial constraints.

Diagnostic Discovery

Trends and Harsh Realities

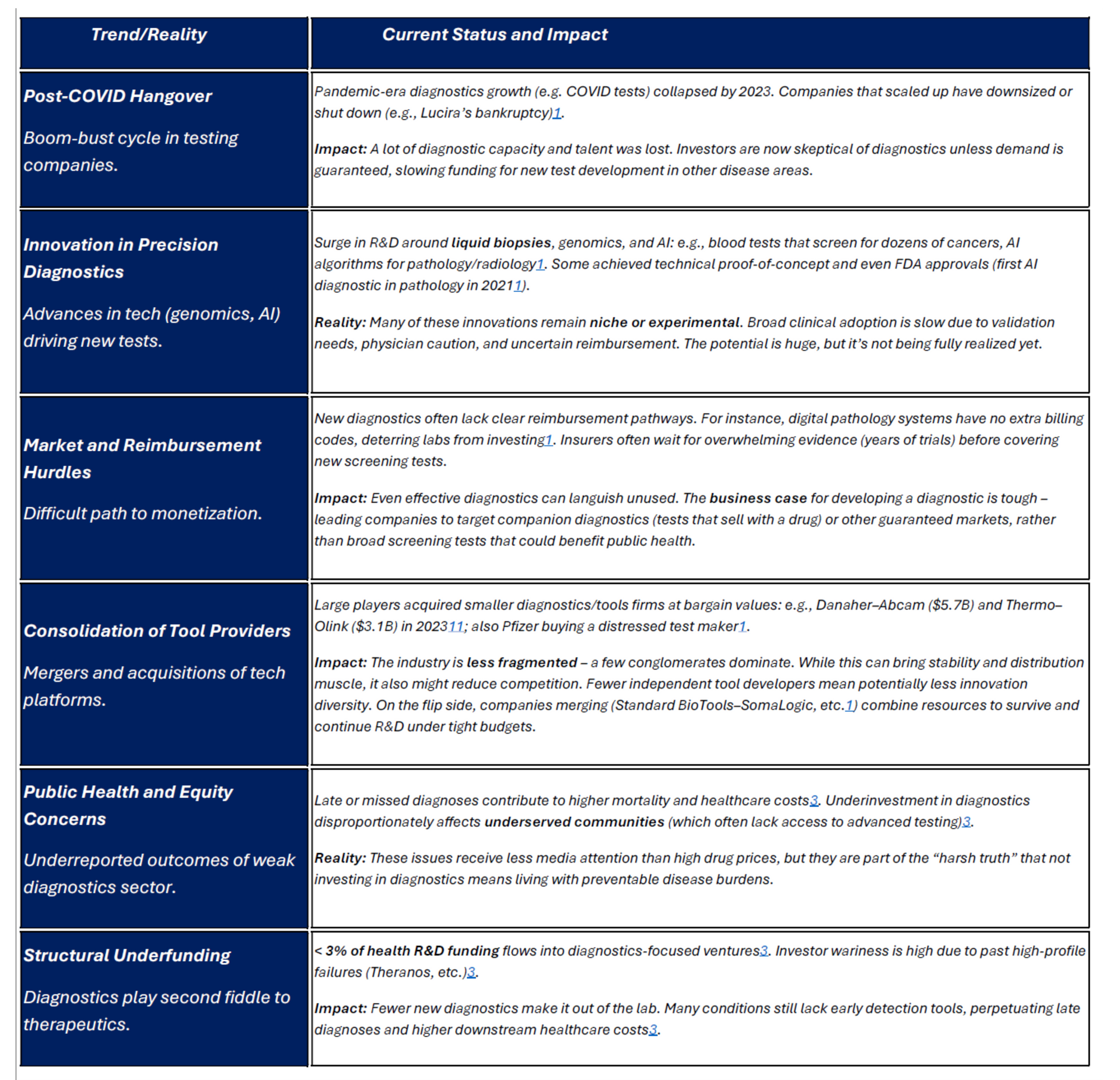

Discovery-stage research in diagnostics – spanning diagnostic tests, research tools, imaging agents, etc. – often operates in the shadow of therapeutics, yet it is equally critical for healthcare. Diagnostics enable early disease detection, guide treatment decisions, and improve patient outcomes (not to mention their role in public health). However, the diagnostics sector has long been the “poor cousin” in life sciences R&D, and current realities reinforce that:

- 1. Chronic Underinvestment: A striking imbalance exists in R&D funding: historically, only about 3% of total healthcare R&D investment goes into diagnostics [1] (including tools and testing platforms). The vast majority of funding and venture capital flows to therapeutics. This gap became even more pronounced recently – in 2023, U.S. diagnostics and research-tool startups raised just $6.2B in VC, a 37% drop from 2022 [2]. First-time financings for new diagnostics companies were down 31% [3]. The consequences of this long-term underinvestment are tangible: fewer innovative diagnostic ideas get developed, and many conditions still lack early detection methods. For instance, there is intense medical interest in multi-cancer early detection blood tests (liquid biopsies) and better Alzheimer’s diagnostics. Such technologies are being researched, but the funding available is a fraction of that for developing new cancer drugs or Alzheimer’s treatments. As a result, progress is slower than it could be. An underreported truth is that late or missed diagnosis due to limited diagnostic tools leads to higher downstream healthcare costs and worse outcomes [4] – essentially, we pay for it on the back end, but it’s not accounted for when budgeting R&D.

- 2. Post-COVID Hangover in Testing: The 2020–21 pandemic put diagnostics in the spotlight, with massive public and private spending on testing (PCR tests, rapid antigen kits, etc.). Some diagnostics companies grew exponentially during that period. However, by 2022–2023, demand for COVID-19 testing plummeted, and many testing-focused companies crashed. For example, Lucira Health, which made at-home COVID tests, went bankrupt in early 2023 when sales evaporated – as noted, Pfizer scooped it up for peanuts [5]. This boom-bust cycle left investors wary of diagnostics once again. Many generalist VCs who dabbled in diagnostics during the pandemic retreated afterwards, feeling the market is too unpredictable. The industry is actually worse off in some respects: several up-and-coming diagnostics startups that scaled for COVID either folded or had to drastically pivot, burning investor confidence. The lesson investors took was that diagnostics can be very volatile and heavily tied to public health cycles, making them “less attractive” than the steadier revenue prospects of therapeutics. This is arguably shortsighted, but it’s the sentiment in board rooms. So, despite the public realizing in 2020 how crucial diagnostics are, by 2025 funding for non-COVID diagnostics is back to being skeletal.

- 3. Market and Adoption Barriers: Even when a new diagnostic test gets developed, getting it adopted into routine care is an uphill battle. Diagnostics typically face a tougher commercial path than drugs: reimbursement is lower and more complicated, and convincing physicians to change testing habits can be slow. A stark example: AI-based diagnostic software – like digital pathology and radiology tools – have shown ability to improve detection (e.g., catching cancers that pathologists sometimes miss [6]). Yet, U.S. labs have little financial incentive to adopt them because there are no reimbursement codes paying extra for AI use. A hospital doesn’t get paid more for finding a cancer with an AI assist versus without, so many are hesitant to invest in these systems. Similarly, innovative screening tests (like a multi-cancer blood test) might not be covered by insurance for years, until long-term outcome data convinces payers. The result is a Catch-22: investors fear diagnostics won’t make money, so they don’t invest; without investment, it’s hard to generate the evidence to change clinical practice and reimbursement. Many promising diagnostics languish in this purgatory. Underreported reality: some diagnostics companies with technically brilliant products failed not because the test didn’t work, but because they couldn’t crack the code of getting insurers and providers to adopt it. The collapse of Theranos (a fraud case) also cast a long shadow, making investors and regulators extra cautious of bold diagnostic claims.

- 4. Research Tools and Platform Consolidation: Many “discovery diagnostics” firms actually produce the tools and platforms that enable research and testing (for instance, DNA sequencers, mass spec devices, high-throughput assay platforms). This arena saw significant consolidation in recent years. In 2023, large conglomerates made multi-billion-dollar acquisitions: Danaher bought Abcam for $5.7B and Thermo Fisher bought Olink for $3.1B – both deals involving companies that provide specialized research reagents or proteomics technology [7]. This indicates that while the market for tools had a downturn (fewer biotechs buying equipment), the big players viewed these tech assets as strategically important for the long run and swooped in at lower valuations. The impact: the industry is now less fragmented, dominated by a few giants (Thermo, Danaher, Illumina, etc.) controlling key tool categories. For researchers, this consolidation can mean more integrated product offerings but also potentially higher prices and less customization. For the smaller tool innovators, the message is you either find a niche or eventually get acquired. In 2024, Standard BioTools and SomaLogic (mid-size tool companies) merged in a ~$1B stock deal [8] as a survival strategy, reflecting the “merge or die” mentality. Overall, the pace of brand-new platform creation in diagnostics may slow since incumbents have so much market power and can outcompete or acquire newcomers quickly.

- 5. Regulatory Outlook: Regulation of diagnostics is evolving. The FDA historically exercised enforcement discretion on many lab-developed tests (LDTs), but there’s pressure to tighten oversight after some high-profile test failures. Upcoming legislation (e.g., the VALID Act, still pending) and FDA guidance suggest that more diagnostics will require regulatory approval rather than slipping by as LDTs. In the short term, this can increase the cost and time to bring a new test to market (more like a drug pathway). On the other hand, it may improve reliability and trust in diagnostics. The FDA did grant emergency use authorizations at record speed during COVID, which showed a fast-track is possible when urgency is high. Now, outside of emergencies, the agency is grappling with how to ensure quality without stifling innovation. Additionally, Europe’s new In Vitro Diagnostic Regulation (IVDR) imposed stricter requirements in 2022, which impacted any North American companies selling in the EU (some had to redo validations or even pull products from EU market due to compliance burden). In short, the regulatory landscape is becoming more rigorous for diagnostics, which, while good for patients, does raise the bar (and cost) for discovery-stage companies working on new tests.

In summary, diagnostic discovery in 2025 operates on thin margins and faces headwinds at multiple levels: funding scarcity, market inertia, and increasing regulatory expectations. The paradox is that diagnostics arguably offer huge value – catching disease early or stratifying patients properly can save many lives and dollars – but our system doesn’t reward developing them in the way it rewards new therapies. The table below captures key trends and realities in the diagnostics sector:

Table 2. Key Trends & Realities in Diagnostic Research & Tools (North America, 2025)

(Sources: Venture funding stats

[1]; case studies from industry news

[2]

[3]; analysis of diagnostic adoption and outcomes

[4].)

Implications: For life science executives and policymakers, the diagnostics sector presents both challenges and opportunities. The challenge is clear: the traditional market incentives for diagnostics are weak. To break the cycle, it likely requires policy intervention (such as better reimbursement schemes for innovative tests, or public-sector funding to de-risk diagnostics R&D). Encouraging signs include government and foundation programs – for example, the U.S. NIH launched initiatives in early cancer detection (the Cancer Moonshot has a diagnostics component) and pandemic preparedness that fund diagnostic innovation. Also, some pharma companies are investing in diagnostics development for patient selection (companion diagnostics for their drugs), which indirectly pumps money into the field.

Looking ahead, a mindset shift is needed among investors and healthcare payers to treat diagnostics as equal in importance to therapies. Without that, improvements in therapeutic outcomes will hit a ceiling, because so many illnesses rely on timely and accurate diagnosis. The harsh but real scenario: a breakthrough cure isn’t useful if patients are diagnosed too late to benefit.

Organizational Approaches

Who Does Discovery and How Are They Faring?

Discovery-stage life science research is conducted by a mosaic of organization types – each with different motivations, structures, and pain points. Let’s analyze how startups, large pharmaceutical companies, academic labs, and government research institutes are each approaching discovery in 2025, and what objective realities they face:

| Organization Type | Approach to Discovery R&D | Current Reality (2025) |

|---|---|---|

| Biotech Startups

(Small & mid-size companies) |

Agile, singular focus on innovation (often one lead program or platform). Typically spin out of academic research to commercialize a new idea. Aim to generate proof-of-concept data quickly to attract funding or partnerships. | Severe funding pressure – many early-stage biotechs face a cash crisis (up to 50% risk closure

by 2025 without new capital). The ones that survive often do so by narrowing their pipelines, pursuing “hot” indications, or merging with other startups. Outcome: A bifurcation is emerging: a few well-funded winners advancing projects, and a long tail of struggling startups pivoting or winding down. Innovation continues, but at a slower pace and lower volume than the bio-boom years. |

| Large Pharma Companies

(Major corporates) |

Mix of internal R&D and external sourcing. Maintain in-house discovery teams for core therapeutic areas, but also scout academia and biotechs for promising candidates to in-license or acquire. Emphasis on rigorous validation and scalable projects that align with strategic portfolios. | Under cost and productivity scrutiny. Many have restructured R&D to focus on fewer areas and late-stage development. Faced with major patent cliffs (~$500B revenue at risk by 2030), they are allocating huge budgets to acquire innovation externally. Internal discovery research that is high-risk or long-term is harder to justify in this climate. Outcome: Pharma is increasingly dependent on external innovation to feed its pipeline. While they have deep pockets, their own early-stage labs often hew to “safe” projects and incremental tweaks. There’s concern that cutting internal discovery too much could leave them empty-handed if the biotech well dries up. |

| Academic Labs & Universities

(Nonprofit research) |

Focus on fundamental science and exploratory research. Academics excel at identifying new biological mechanisms and early drug/diagnostic concepts. Not product-driven; success is measured in publications and grants, though tech transfer offices aim to patent and license promising findings. | Remain the primary source of novel targets and insights, but struggle with translation to products. Reproducibility issues

are significant – ~70% of researchers have failed to replicate published results, leading industry to be cautious with academic findings. Funding is steady but flat

; e.g., NIH budgets for basic research have not grown (0% increase FY2025), limiting the scope of new projects. Outcome: Academia produces a wealth of discoveries (many pharma projects originate in academia), but many remain “trapped” in the lab. Initiatives like drug discovery centers at universities and academia-industry collaborations help, yet the “valley of death” between a paper and a prototype is still where good ideas often stall. |

| Government & Nonprofit Institutes

(NIH, research institutes, public-private partnerships) |

Mission-driven research addressing public health needs and foundational science. Examples: NIH intramural labs, disease-focused institutes (like cancer centers), and new agencies like ARPA-H. Can take on long horizons and higher-risk projects that the private sector avoids, including infrastructure-building (biobanks, large-scale trials for validation). | Constrained by budget caps and political priorities. Major agencies (NIH, NSF) saw effectively 0% growth in R&D funding for 2024-2025

after inflation. This limits new initiatives. However, new models are being tried: ARPA-H (launched 2022)

has over $1B invested in high-risk programs to “transform” health outcomes, aiming to turbo-charge certain areas like gene therapy, cancer detection, etc. Outcome: Government research provides crucial support (especially for early discovery in neglected areas and for validating academic findings), but bureaucracy and limited funding mean it cannot fill all the gaps left by industry. Programs like ARPA-H and other accelerators are promising, but it’s too early to judge their success. Public institutes often end up partnering with industry to push a discovery into development due to the cost and scale needed for later stages. |

Cross-Cutting Reality – Collaboration is Key: It’s evident that no single sector can do it alone in discovery R&D. The most successful recent examples of translating a lab idea into a therapy involved tight collaboration: academics working with biotech entrepreneurs to spin out a company; biotechs partnering with pharma early to access resources; public institutes providing seed funding or infrastructure at critical junctures. A study of drug origins found that many approved drugs in the last decade stemmed from academic research, but nearly all had industry involvement to drive development. Essentially, the system relies on handoffs: academia discovers, biotech innovates and de-risks, pharma develops and commercializes. In 2025, these handoffs are under strain because each link in the chain is under pressure.

The funding crunch for biotechs means fewer academic spinouts get off the ground – some ideas sit on the shelf even after promising papers. Pharma’s hunger for new products is high, but they sometimes find less to choose from in their shopping cart because early pipelines are drier. Nonprofits and new initiatives (like the venture philanthropy model, where foundations fund drug discovery for their disease) are trying to bridge gaps.

For an executive overseeing R&D strategy, the implication is to nurture relationships across sectors. Companies that proactively collaborate – e.g., funding academic labs through sponsored research, co-developing programs with biotech partners, or leveraging government grants – are likely to weather the storm better and come out with robust pipelines. Those that operate in silos risk missing out on external innovation or duplicating work inefficiently. In this climate, a spirit of collaboration and resource-sharing is not just nice to have, it’s becoming essential to get things done.

Vendors, Suppliers & Manufacturers

The Support Ecosystem Under Strain

No discovery-stage research can progress without a vast array of vendors and suppliers – from lab reagent makers and instrument manufacturers to contract research and manufacturing organizations (CROs/CMOs) – that provide the tools, materials, and services fueling experiments. This support ecosystem has been grappling with its own set of challenges in the current climate:

💼 Ripple Effect of R&D Slowdown

Lab equipment and service providers are feeling the crunch as their biotech and pharma clients slash R&D spending. For example, Thermo Fisher Scientific reported a sharp drop in demand from small biotechs, with revenues in its life-science solutions division down ~18% in late 2023. Companies across the sector have issued profit warnings and cut jobs due to this slowdown.

⚙️ Consolidation in Tools & Services

Larger suppliers are absorbing smaller ones in a bid to broaden offerings and gain efficiencies. Big deals in 2023 included Danaher buying Abcam (antibodies & research reagents) for $5.7B and Thermo Fisher acquiring Olink (proteomics tech) for $3.1B. Meanwhile, mid-tier players merged to survive (e.g., Standard BioTools and SomaLogic in a $1B all-stock merger). This consolidation wave is reshaping who scientists buy from.

📈 Cost Pressures and Shortages

The cost of conducting research has spiked , squeezing both labs and suppliers. Prices for lab essentials are way up (e.g., nitrile gloves +91% since 2018), and critical materials are often in short supply. A startling example: lab monkey prices soared 15× pre-2020 levels amid COVID-driven demand and import crackdowns. Such inflation and shortages strain vendor supply chains and force labs to cut back experiments.

🔗 Global Supply Fragility

Despite talk of “onshoring,” the life sciences supply chain remains highly globalized – and vulnerable. About 60% of active pharmaceutical ingredients (APIs) are produced in China, and many reagents rely on overseas raw materials. Companies realized disentangling from foreign suppliers is exceedingly complex . Geopolitical tensions or trade restrictions (e.g., export bans on lab animals or chemicals) could disrupt R&D unless contingency plans and dual sourcing are improved.

- 1. Slumping Sales and Retrenchment: The post-2021 R&D slowdown has cascaded to vendors. Suppliers of lab instruments, reagents, and services, who boomed during the biotech bull market, saw orders dry up as customers cut spending. Thermo Fisher’s CEO noted in Q3 2023 that many small biotech clients have become extremely cautious, delaying or reducing orders [1]. As a result, Thermo Fisher missed revenue targets and cut its annual guidance [2]. Its life-science tools unit’s revenue dropped 18% in one quarter [3]. Similarly, Danaher and Agilent both reported weaker sales in late 2022 and 2023, explicitly citing reduced demand from biotech customers. Agilent Technologies (a major lab equipment maker) initiated layoffs – eliminating ~450 jobs (2% of staff) in late 2023, and another ~3% in mid-2024 – saying the lab market recovery has been “slower than expected” [4] [5]. These cutbacks mirror what’s happening in biotech: just as biotechs trimmed down to extend their runway, tool vendors are cutting costs to weather the dip. CROs and CDMOs have also felt it: many report that smaller biotech clients are postponing or canceling projects, leading to a dip in new bookings. Some CROs have pivoted to rely more on stable big pharma contracts to get through the lean times. In essence, the entire R&D “food chain” has tightened. The silver lining for well-funded players is they can negotiate better deals – some vendors are offering discounts or favorable terms to keep business – but the overall environment is one of retrenchment.

- 2. Consolidation and Strategic Shifts: As noted, big fish are eating little fish in the supplier pond. This consolidation has a few motivations: acquiring new technology capabilities, achieving cost synergies, and positioning to be a one-stop-shop for customers. For example, Danaher’s acquisition of Abcam gave it a highly regarded portfolio of antibodies and research reagents (boosting Danaher’s presence in discovery research labs worldwide) [6]. Thermo’s purchase of Olink brought in an advanced proteomics assay platform, complementing Thermo’s mass spectrometry business [7]. The timing of these deals – at a low point in valuations – suggests the big companies saw an opportunity to buy valuable assets more cheaply than a couple years ago. Additionally, smaller vendors have merged to gain scale. The Standard BioTools–SomaLogic merger combined a lab instrumentation firm with a proteomic data company, aiming to offer integrated solutions and cut overhead [8]. The impact on researchers could be mixed: on one hand, a consolidated vendor might offer bundled deals and more convenient service; on the other hand, less competition might mean less bargaining power for labs and potentially slower innovation (fewer independent R&D efforts among suppliers). For the vendors themselves, consolidation can help ride out the storm by removing duplicate costs and expanding market reach. But it also means the survivors have to manage very broad product lines (which can be challenging to integrate). We’re also seeing strategic shifts like vendors focusing on core profitable segments and dropping peripheral lines. For instance, some instrument companies have quietly discontinued low-margin product lines (like basic lab consumables) to focus on high-end equipment and consumables that ensure recurring revenue. Services firms (CROs) similarly are focusing on their key pharma clients and cutting back marketing to cash-strapped biotechs. All of this results in a leaner supplier landscape, optimized for the customers who still have budgets (mostly big pharma, government, and well-funded biotechs).

- 3. Supply Chain and Cost Challenges: Beyond demand issues, vendors have faced supply-side challenges. The pandemic and ensuing global logistics snarls hit the life science supply chain hard. Shortages of items like pipette tips, plastic disposables, and culture media became acute in 2021–2022. While those specific shortages have largely eased by 2025, the lesson was learned: the supply chain is vulnerable. Additionally, costs of raw materials and logistics remain elevated. Energy prices and commodity chemicals went up, and some haven’t fully come down. Vendors passed a lot of these increases to customers. A Nature report in 2023 documented that an average lab’s supply costs jumped ~27% from 2018 to 2022 [9]. One striking figure: nitrile gloves – an essential disposable – cost about 91% more in 2022 than they did in 2018 [10]. This was due to skyrocketing demand (and some price-gouging) during COVID and rubber supply issues. Similarly, certain enzymes and reagents saw big price hikes due to supply chain bottlenecks. Researchers on tight budgets had to ration or seek cheaper alternatives, sometimes compromising on quality or consistency. Vendors meanwhile had to navigate volatile supply availability; some smaller reagent makers were unable to fulfill orders on time, pushing labs to bigger suppliers who could stockpile. Another dramatic supply challenge has been laboratory animals, particularly non-human primates (NHPs). During COVID, NHP demand for vaccine research soared, but exports from China (the main supplier of research monkeys) were cut off in 2020. Then in 2022–2023, a U.S. DOJ investigation (Operation Flying Primates) uncovered illicit imports of wild-caught monkeys from Cambodia, leading to import suspensions [11]. The result: a severe NHP shortage in the U.S. By 2023, prices for research monkeys reportedly jumped to ~15 times pre-pandemic levels [12]. Companies like Charles River (a major supplier) had to scramble to breed more monkeys domestically and divert supply from other countries. This shortage has directly slowed some discovery projects that rely on NHP models (like certain neuroscience or vaccine studies) – either making them prohibitively expensive or causing long delays in scheduling. The monkey shortage is a niche example, but it underscores how fragile parts of the R&D supply chain are. In response, the NIH and others are investing in expanding domestic animal research facilities, and many labs have refined their study designs to use fewer animals or alternative models where possible.

- 4. Globalization Risks and “Onshoring” Dilemmas: The life sciences supply chain is global: reagents from China, APIs from India, instruments from Germany, etc. This globalization keeps costs down but creates dependencies. Over 70% of active pharmaceutical ingredients used in U.S. medicines are manufactured abroad (often in just a few countries). The pandemic, plus geopolitical tensions, brought calls to “onshore” or diversify these supply chains for national security. In practice, shifting supply chains is slow. By 2025, there’s been limited relocation – some API manufacturing projects started in the U.S. with government incentives, and a few critical reagent supply lines are being established domestically, but these represent a small fraction of overall volume. Companies are reluctant to move production from low-cost bases without clear economic incentive, and building new facilities takes years. Instead, what we see is companies increasing inventory buffers (stockpiling critical supplies) and qualifying secondary suppliers in different countries as contingency. For instance, a biotech might ensure it has a European source for a key chemical as backup to its Chinese source. However, maintaining large inventories ties up capital, which not everyone can afford in this tight environment. Another wrinkle: export controls and trade policies. The U.S. government has considered measures to secure pharma supply chains, but there’s also the risk of foreign governments restricting exports (like China did with NHPs). If, say, a political dispute led to China banning export of a certain reagent or raw material, many U.S. labs would be caught flat-footed. The bottom line is that as of 2025, the supply chain remains global and somewhat brittle. Vendors and their customers are more aware of the risks now, but mitigating them fully is expensive and not yet achieved. Thus, while not front-page news, the possibility of supply shocks is a background worry for R&D planners.

Implications: The health of the vendor/supplier ecosystem directly affects research productivity. Right now, that health is shaky. Well-established suppliers will survive, though with possibly reduced product lines and slower innovation as they cut costs. Some smaller suppliers might not make it, especially if they were reliant on a vibrant startup customer base. For R&D teams, careful vendor management is crucial: multi-sourcing critical supplies, keeping communication open about vendors’ stock or financial stability, and perhaps locking in long-term supply agreements for key items are wise moves. We’ve seen some big pharmas actually provide upfront payments or volume guarantees to suppliers for important materials to ensure continuity (a practice reminiscent of how chip companies dealt with suppliers after chip shortages).

From a strategic viewpoint, companies could consider bringing in-house certain critical capabilities if a vendor looks unstable – for example, building an internal chemistry synthesis team if a trusted CRO partner is faltering. However, this goes against the general trend of outsourcing and might be a temporary safety measure. On the opportunity side: challenges for incumbents can be openings for new entrants. If a big vendor stops supporting a certain older instrument line, a smaller company might pop up to service those customers. Some agile service providers are finding niche demand (like specialized analysis that biotechs used to outsource abroad but now prefer locally). Still, overall the ecosystem won’t truly rebound until its customer base (the biotechs and pharma) ramp up discovery spending again. In the meantime, expect the support sector to continue consolidating and focusing on core profitable offerings, with less tolerance for speculative or fringe products.

CASE STUDY

Logistics as a Strategy

kbDNA Inc.

Domestic Expansion for Supply Chain Resilience

In 2024, kbDNA established a new logistics center in North Carolina, a move shaped by the disruptions experienced during the pandemic era. This center was developed not just to increase capacity, but as an adjustment to a shifting supply chain environment. Located in North Carolina, the hub enables more competitive material movement and storage, allows for quicker turnaround, and offers increased flexibility for customers. The initiative also aims to strengthen preparedness for a range of possible future disruptions, including shipping delays, regulatory changes, or market shocks.

Impact on the Supply Chain

Relative to organizations that continue to rely on international shipping and third-party warehousing, kbDNA’s operational model demonstrates increased robustness. Partner laboratories have reported reduced delays and more reliable access to critical supplies. In today’s environment, where timing and reliability are paramount, these operational changes provide a tangible advantage.

Lessons Learned and Industry Implications

The experience of the past five years underscores that local capacity and logistics preparedness have become essential, rather than optional. Investments in domestic infrastructure address clear industry challenges, and position organizations—including kbDNA and its clients—to better manage future uncertainties.

Broader Context for Discovery-Stage Research

No discovery-stage research can progress without a vast array of vendors and suppliers—from lab reagent makers and instrument manufacturers to contract research and manufacturing organizations (CROs/CMOs)—that provide the tools, materials, and services fueling experiments. This support ecosystem has been grappling with its own challenges in the current climate.

Conclusion

Underreported Realities

In wrapping up, it’s worth spotlighting a few objective realities that often go underreported amid the industry’s announcements and narratives:

- The Reproducibility Crisis is Stalling Innovation: The “dirty secret” in biomedical science is that a significant fraction of published research cannot be replicated reliably. This isn’t just an academic worry – it directly affects drug discovery success rates. Pharma insiders have noted that 50–70% of external academic findings they attempt to validate do not hold up [1]. That means a lot of time and money chasing false leads. It contributes to the massive attrition in pharma pipelines and is a hidden efficiency drain on the entire sector. Efforts are underway (e.g., journals pushing for better methodology, NIH encouraging rigorous study design) but progress is slow. Until this is addressed, we’re effectively wasting a big chunk of discovery effort on results that won’t translate. It’s a hard problem – part of the nature of exploratory research – but awareness is the first step. Currently, the reproducibility issue doesn’t grab headlines like a new AI discovery does, yet it might be one of the biggest drags on R&D productivity.

- Human Capital and Morale: Behind every discovery project are scientists – and they’ve been through a rough time. The boom-and-bust has led to job insecurity in biotech (15k+ layoffs in 2024 [2] means many scientists out of work or uncertain) and intense competition for funding in academia (NIH grant success rates are low, often ~20% or less). The result can be brain drain: talented young researchers may choose other careers (tech, finance, etc.) or if they stay, morale can dip under constant stress. We risk losing a generation of life scientists if the field is seen as too unstable. This rarely gets discussed in earnings calls or investor meetings. Also, diversity initiatives and efforts to bring in fresh talent might take a backseat when companies are in survival mode. A long-term implication is that less human talent enters or stays in the field, which could slow innovation (fewer bright minds working on the problems). Anecdotally, graduate enrollments in some biomedical PhD programs have dipped slightly post-pandemic, and some biotech hubs see folks moving to sectors perceived as more stable.

- Geographical Shifts in Innovation: While this report focuses on North America, it’s notable that other regions have been ramping up investment in life sciences. China, for instance, has heavily invested in biotech R&D and startup funding (with government support) and has built a robust domestic biotech sector. Europe, despite some funding woes, still produces strong science and has government initiatives for strategic areas (like the EU’s programs in advanced medicines, and country-level funds in the UK, Germany, etc.). If North America’s ecosystem slows, there’s a chance that some innovation will shift to these other regions. We already see global pharma sourcing innovation from China (e.g., Merck & Co. licensing a cancer drug from a Chinese biotech). North America has long been the powerhouse of biotech, but leadership isn’t a birthright; it’s maintained by continuous investment. A harsh reality is that the U.S. can’t get complacent – other countries learned from our success and are vying for their share of the pie. The extent of this shift is debated, but it’s an undercurrent – e.g., venture funding in Asia-Pacific hasn’t dropped as much as in the U.S. in some recent quarters, and talent flows are becoming more global.

- Patient Impact – the Lagging Indicator: Ultimately, the success or failure of discovery-stage research is measured in new solutions for patients. A sobering reality is that despite all the scientific advances in the last decade, improvements in many patient outcomes have been incremental. For example, cancer mortality has been falling, but much of that is attributable to reductions in smoking and some earlier detection, not just new drugs. We have cutting-edge CAR-T cell therapies for cancer, but they reach a tiny fraction of patients because of cost and complexity. There are still no approved disease-modifying drugs for conditions like Alzheimer’s (aside from some very recently approved amyloid-targeting antibodies with debated effectiveness). Antibiotic resistance is rising, yet no truly novel antibiotic classes have been discovered in decades. These gaps are not for lack of scientific knowledge – we know a lot about these problems – but because translating knowledge into widespread clinical impact is slow and hard. Some of this is inherent, but some is the byproduct of the underreported issues above (lack of diagnostics, etc.). So while press releases celebrate a new pathway discovery or a mouse cure for X, the translation to human benefit is often 10-15 years out, if it happens at all. This is a harsh truth that the industry doesn’t like to dwell on because it sounds pessimistic, but recognizing it should galvanize efforts to improve the pipeline efficiency. It also highlights the importance of sustaining discovery research even when immediate outputs aren’t obvious, because today’s basic science is often the seed for tomorrow’s breakthrough – but if we chop all the seedlings in hard times, we reap nothing later.

Conclusion: The discovery-stage life sciences sector in North America is at a pivotal juncture. On one hand, the scientific prospects have never been more exciting – we have tools (like CRISPR, AI, single-cell omics) that were unimaginable a generation ago, and we understand biology at a depth that should allow unprecedented interventions. On the other hand, the real-world environment to nurture these prospects has rarely been more challenging – funding is tight, focus has narrowed, support systems are strained, and the “easy wins” in biomedicine (low-hanging fruit) have mostly been picked over the past decades, leaving tougher problems ahead.

The current state can be summarized as one of cautious advancement under duress. Progress is still being made – important drug targets are being identified, promising drug candidates are in pipelines, and some nifty diagnostics are emerging – but it’s often despite the headwinds, not because conditions are favorable. Many in the industry have adopted a sober, heads-down approach: do the best science you can with what you have, and cut anything that doesn’t show promise. There’s less tolerance for blue-sky exploration, at least for now.

If the trends in funding and risk-aversion continue unchecked, there is a concern about a slowdown in the breakthrough pipeline later in this decade. The full impact of today’s cuts might only be felt years from now, when the absence of early-stage projects means fewer new products. It’s like skipping planting seeds for a season – you don’t notice immediately, but later you have less to harvest. Some experts worry about a 5-year “innovation gap” in the early 2030s as a result of 2022–25 being lean years for starting new programs (especially in certain therapeutic areas).

However, history in biotech is cyclical. The optimistic view is that the incredible pace of scientific discovery will eventually force a way forward – big new ideas will come that investors can’t ignore, and capital will flow again. There are already signs of life: for instance, the excitement in obesity therapeutics (with multiple companies now investing in next-gen metabolic therapies) shows that a single clear success (the drug semaglutide in this case) can reinvigorate a field. Similarly, the recent advances in mRNA technology (spurred by vaccines) are now being applied to cancer and other diseases with renewed vigor.

In keeping with an unfiltered perspective, though, we must acknowledge the systemic issues that need addressing: the industry’s R&D engine needs some fixing and re-fueling. This includes rethinking funding models for early research (perhaps more public-private partnerships), improving how we validate academic findings (to spend less time on dead ends), building more resilient supply chains, and fostering talent even during downturns so that when the cycle turns up, we haven’t lost capacity.

Ultimately, discovery-stage research is where the future of medicine is born. At present, it is under strain but not broken. The resilience of the scientific community and the collaborations across sectors are keeping the flame of innovation alive even in tough times. The objective reality is sobering, but it should serve as a call to action: to reinvest and double down on the foundational research that leads to tomorrow’s cures and diagnostics. If stakeholders heed this call – if investors look beyond the next quarter, if governments view R&D as infrastructure, if companies balance short-term needs with long-term vision – then the current storm can be ridden out and the sector can emerge stronger. In the meantime, the discovery engine continues chugging, albeit at a slower pace and with fewer cars, driven by the dedication of scientists who, even in harsh conditions, persist in the quest for knowledge and solutions. The truth may be harsh, but recognizing it is the first step toward ensuring that the next status report in a few years can report not just harsh realities, but how they were overcome.